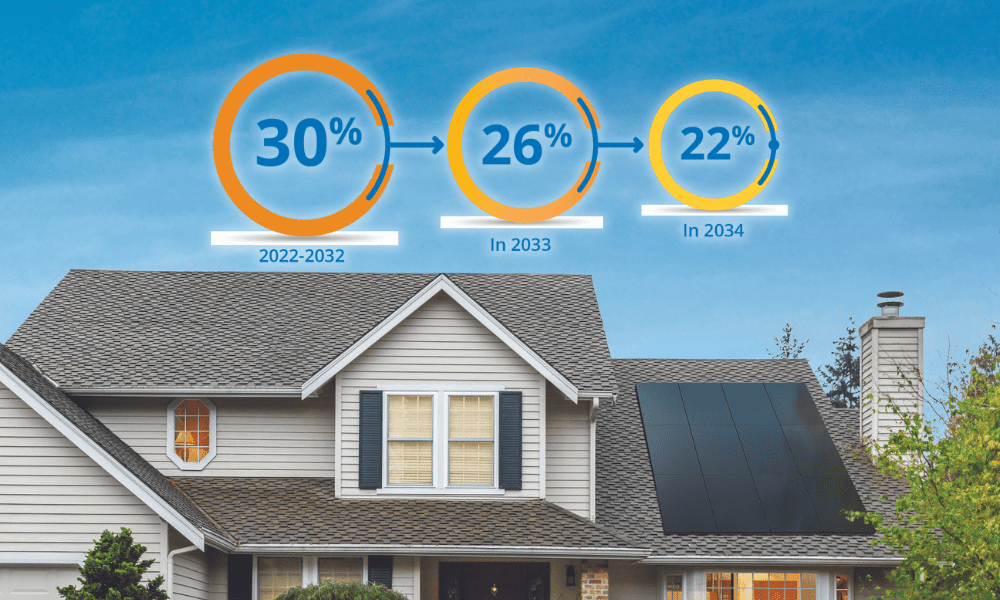

Exciting news! The Inflation Reduction Act (IRA) has been passed, bringing substantial benefits to solar customers. Residential installations and those under 1 MW will enjoy a 30% tax credit for a decade, retroactive from January 1, 2022. Larger projects above 1 MW can reach 30% by meeting specific requirements, potentially resulting in a 70% tax credit, especially for installations in low-income areas and the use of domestic products.

Non-profits, state, and local government entities will now receive direct payments for tax benefits, even without tax obligations. Solar battery installations also qualify for the 30% tax credit, providing stability to consumers and the grid.

Additionally, electric vehicle (EV) enthusiasts can benefit from tax credits of up to $7,500, with eligibility influenced by production location, battery components, vehicle price, and owner’s income. New to the scene is a tax credit of up to $4,000 for used EVs under $25,000.

Wondering how these changes affect you? Let us guide you through your solar journey. Get started today and harness the power of these tax benefits for a greener, more affordable future.